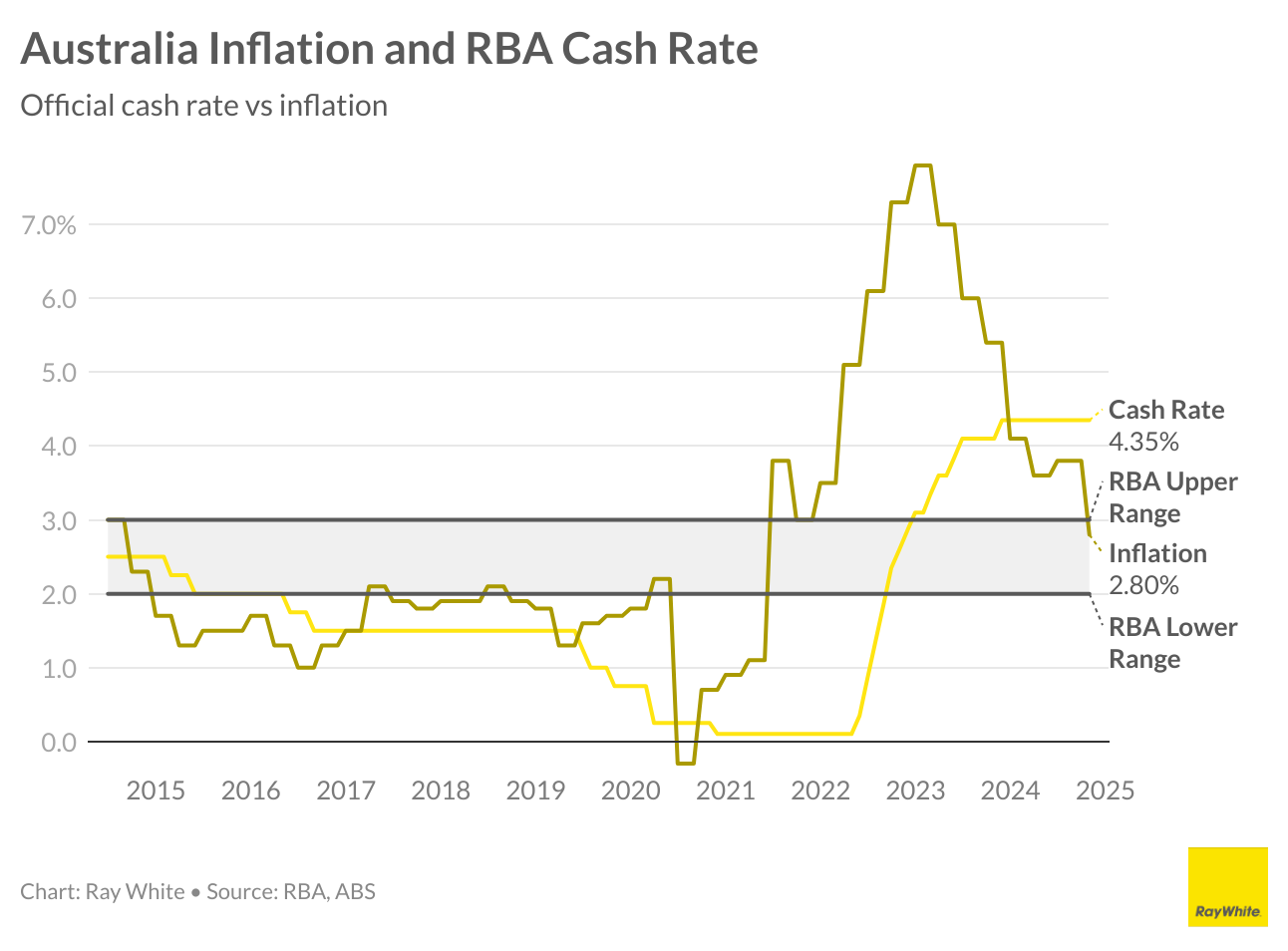

We are getting close but unfortunately November was not the month for a rate cut. Although inflation is now within the target range, hitting 2.8 per cent last week, the RBA decided to keep rates on hold.

Why the hesitation? There are a few reasons. The main one being that the economy appears to be doing ok, even with higher rates. Importantly, there is significant job growth – if people want a job, they are still able to find one. The second is that the declining inflation rate was at least partially manufactured by Federal Government programs – the National Energy Bill Relief resulted in a decline in energy spending by households. Rental price growth remains high but was moderated by Commonwealth Rent Assistance changes. The third is that while households may be feeling the pinch, they are still spending a lot on holidays – a key component of inflation was a rise in recreational spending.

But there are some more sobering signs in the economy. The first is that we continue to see the participation rate increasing and this is at least partly driven by rising household stress. Youth unemployment is now close to 10 per cent and rising – younger people are bearing the brunt of the economy slowing. And while the economy is growing, the rate of growth is lacklustre – the annual increase in June was just one per cent, the slowest growth rate since the early 1990s recession, excluding the COVID-19 pandemic period.

Furthermore, some of the price rises we are seeing are from supply side challenges, something that can’t be easily controlled by increasing rates. Fresh produce increases came because of adverse weather conditions, not because we are all eating too many apples. Electricity prices have been driven down by government bill relief but their increase over recent years has less to do with us using more electricity (which we do) but more to do with challenges in electricity generation which will be ongoing for some time.

While it was a hold this month, the RBA should look to cut in December. Interest rate cuts take time to have an impact on the economy. The exact timing of this lag is uncertain however some research has shown it can be as much as 18 months. Our economy is holding on for now, but this is unlikely to last.