The Australian housing market is experiencing a notable shift, with affordability driving unexpected trends across different property types. Affordable house price growth is now outpacing the luxury market. While the opposite is now occurring for apartments.

The traditional outperformance of luxury homes in the real estate market is being challenged by current data showing more substantial price increases in affordable properties. This shift is largely attributed to “mortgage fatigue,” where rising interest rates disproportionately impact owners of expensive homes due to their larger mortgages and higher monthly payments. As a result, demand for luxury properties has cooled, while more affordable homes have become increasingly attractive to buyers.

In the affordable housing segment, the widening cost gap between a newly built home and existing homes has further influenced buyer behaviour. Established properties in this category are seeing heightened interest due to their relative affordability and location in developed neighbourhoods. This trend reflects a broader market adjustment, leading to stronger price appreciation for established homes.

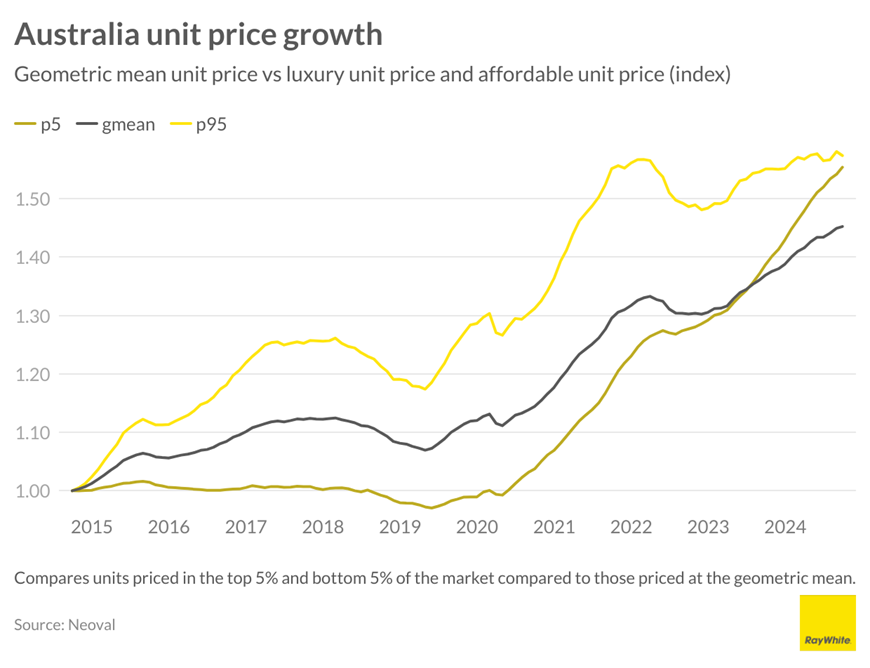

The apartment market presents a contrasting trend to the housing sector, with luxury units outperforming more affordable options in terms of growth. This disparity is primarily driven by downsizers, typically older homeowners or retirees, who are less sensitive to interest rate changes due to their substantial equity or ability to make cash purchases. These buyers are often willing to pay premium prices for spacious, high-quality apartments that offer comfort and convenience.

Unlike the affordable housing segment, the luxury apartment market remains relatively unaffected by rising construction costs. While developers struggle to build cost-effective apartments due to financial constraints, the premium sector can absorb higher construction expenses as affluent buyers are prepared to pay elevated prices. This dynamic has led to a continued growth in the luxury apartment market, even as other segments of real estate face challenges.

Perth is emerging as a hotspot for affordable house price growth, with suburbs like Kelmscott recording impressive gains of over 34% in the past year. Even in relatively flat markets like Darwin, certain areas are bucking the trend. Weddell, for instance, has seen a 6% increase in house prices, making it the cheapest fast-growing suburb for houses nationwide.